India’s transition toward a low-carbon, sustainable energy future has catalyzed a dynamic shift in the country’s power sector. Nowhere is this evolution more evident than in the rise of renewable-focused ventures like NTPC Green Energy Limited, a subsidiary of NTPC Ltd.—India’s largest power producer. As environmental, social, and governance (ESG) priorities shape investment decisions globally, NTPC Green’s share price performance offers insights into both investor sentiment and the broader renewable energy trend.

NTPC Green Share Price: Recent Trends and Live Market Sentiment

NTPC Green Energy Limited has garnered considerable attention in the Indian equities space, as investors look to capitalize on the country’s aggressive clean energy targets. While NTPC Green was previously a business vertical within the parent entity, it has since been spun off to consolidate NTPC’s renewables assets and attract dedicated investment.

Current Share Price Movements

Market participants closely watch live NTPC Green share price updates to gauge short-term momentum and long-term potential. The stock often reflects broader renewable sector trends as well as company-specific milestones—such as project wins, capacity additions, and government policies. In recent trading sessions, NTPC Green shares have exhibited movement in line with sector peers, responding sharply to announcements around solar and wind project awards.

Factors Influencing Price Fluctuations

Several factors drive day-to-day and longer-term price dynamics, including:

- Government policy announcements: India’s aim to achieve 500 GW of renewable capacity by 2030 serves as a major tailwind.

- Quarterly earnings: Investors track both revenue growth and pipeline expansion for clues on momentum.

- Sector sentiment: News on green energy adoption, global investment flows, and competitive landscape.

- ESG fund inflows: Increased allocation by sustainability-focused funds has buoyed shares of green energy companies globally.

One brokerage analyst notably observed:

“Investors are seeking exposure to companies like NTPC Green—seen as instrumental to India’s energy diversification. Their consistent project pipeline and alignment with national targets underpin strong institutional interest.”

Performance Analysis: NTPC Green Versus Sector Benchmarks

Revenue Growth and Capacity Expansion

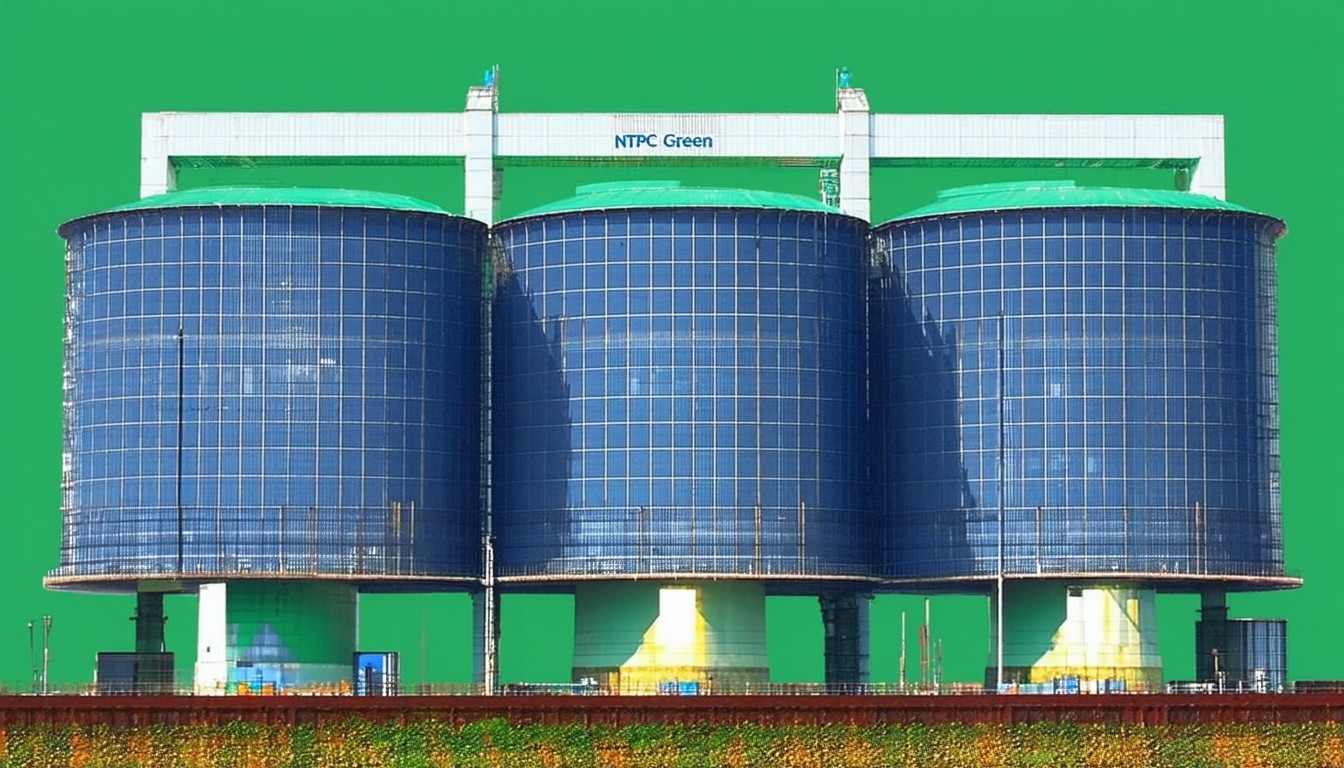

NTPC Green has rapidly ramped up its renewable energy portfolio. With more than 3 GW of operational assets and an ambitious pipeline, the company distinguishes itself through scale and execution. Multiple new projects, both solar and wind, have come online, and longer-term contracts provide revenue visibility.

Data from recent annual reports and industry coverage highlight double-digit growth in both capacity and top-line figures for NTPC’s renewables business. This growth trajectory outpaces some traditional power sector peers contending with coal transition risks.

Share Price Performance in Context

Compared to conventional power utilities, shares of green energy companies—NTPC Green included—have delivered stronger returns over multiple quarters, reflecting investor appetite for future-ready business models.

Key Performance Drivers

- Operational efficiency: Modern renewables assets tend to have lower marginal costs.

- Policy tailwinds: Green-friendly policies and incentives accelerate earnings prospects.

- Market re-rating: Global investors reprice assets seen as beneficiaries of energy transition.

However, it’s worth noting that renewable energy stocks are also exposed to project execution risks, input cost fluctuations (notably in solar module prices), and changes in tariff regimes.

Real-World Example: NTPC Green’s Solar Projects and Stock Reaction

When NTPC Green recently announced the commissioning of a 500 MW solar project in Rajasthan, the market responded with an uptick in share price and trading volume. This pattern of positive price reaction following major capacity milestones has been repeated, underscoring the market’s appetite for scale and reliability in this sector.

NTPC Green and the Broader Renewable Energy Landscape

Competitive Positioning

NTPC Green faces robust competition from listed pure-play renewables companies such as Adani Green Energy, ReNew Power, and Tata Power Renewables. However, its own scale—with financial strength inherited from the NTPC parent—enables more aggressive project acquisition and stable financing.

Institutional and Retail Investor Interest

ESG investing has become a defining trend in the global capital markets, and Indian institutional investors are no exception. NTPC Green is increasingly featured in ESG portfolios, reflecting growing awareness about environmental mandates and sustainable returns.

According to the Securities and Exchange Board of India (SEBI), green and sustainability-themed funds have seen robust inflows. NTPC Green—by virtue of its flagship status and growth ambitions—stands as a core holding in several such funds.

“As global capital leans green, flagship Indian renewables firms like NTPC Green are at the nexus of policy support and investor enthusiasm. This is a defining decade for energy portfolios.”

Technical Analysis: Chart Patterns and Price Indicators

Support and Resistance Zones

Technical analysts often highlight key price zones for NTPC Green shares. Historically, the stock tends to find support following major project wins or strong quarterly reports—suggesting institutional appetite at such levels. Conversely, broader market volatility and sector-wide corrections may create resistance around previous highs.

Volume and Momentum

Spikes in trading volume have frequently coincided with large-scale contract announcements and government renewable auctions. Momentum indicators—such as the Relative Strength Index (RSI)—often show bullish signals when NTPC Green outpaces sector benchmarks, although corrections are not uncommon in the high-growth renewables segment.

Risk Factors

While NTPC Green’s prospects are strong, prudent investors watch for:

- Regulatory changes impacting tariff structures

- Delays or cost overruns in large-scale projects

- Global supply chain issues affecting solar/wind equipment availability

These risks are balanced by NTPC’s demonstrated track record and policy alignment.

The Road Ahead: Strategic Outlook for NTPC Green Shareholders

India’s renewables push sets the stage for further growth in both capacity additions and investor interest. NTPC Green, with its government backing, strong pipeline, and proven execution capabilities, is well positioned to benefit from sector tailwinds.

Analysts expect the company to:

- Grow installed capacity rapidly over the coming years

- Maintain steady top-line and EBITDA growth

- Deepen its bond and equity investor base through sustainability-linked financing

Long-term investors, particularly those with a sustainability mandate, are likely to find NTPC Green an attractive proposition as India accelerates toward a low-carbon future.

Conclusion

NTPC Green Energy Limited has emerged as a bellwether for India’s renewable energy ambitions, with the NTPC Green share price reflecting both sector optimism and company-specific momentum. As the country intensifies its renewable commitments, the stock remains under the spotlight for institutional and retail investors alike. While price volatility and execution risks persist, the strategic advantages and growth trajectory of NTPC Green underscore its significance within the evolving landscape of Indian energy equities.

FAQs

What is NTPC Green Energy Limited?

NTPC Green Energy Limited is a subsidiary of NTPC Ltd. focused exclusively on developing and operating renewable energy projects, including large-scale solar and wind power plants.

How does NTPC Green share price compare to other renewables stocks?

NTPC Green’s share price performance has generally mirrored strong sector momentum, often outpacing traditional utility shares and aligning with other leading green energy companies in India.

What are the main risks associated with investing in NTPC Green shares?

Major risks include regulatory changes, project delays, input cost volatility (such as rising solar module prices), and broader stock market fluctuations due to sector sentiment shifts.

How do government policies impact NTPC Green’s share price?

Favorable government targets and incentives for renewable energy can boost investor confidence and positively affect NTPC Green’s share price, while unexpected policy changes can create volatility.

Can retail investors buy NTPC Green shares directly?

Retail investors can purchase NTPC Green shares if and when the company is listed separately on Indian stock exchanges, much like shares of other public sector undertakings and energy companies.

Leave a comment