Navigating India’s equity derivatives markets begins with a firm grasp of the NSE option chain — a real-time dashboard of option contracts listed on the National Stock Exchange of India (NSE). For active traders, the option chain provides critical transparency into strike prices, open interest, premiums, and market sentiment surrounding indices like the NIFTY 50 and major stocks. More than just numbers, the option chain is a living map, reflecting how investors hedge risk, speculate on market moves, and interpret both macroeconomic and company-specific news.

Over recent years, the proliferation of options trading on the NSE has attracted both seasoned professionals and retail investors. According to data from NSE, option contracts now account for a vast percentage of overall derivatives turnover, testifying to their popularity and perceived value in managing risk and opportunity alike.

Decoding the NSE Option Chain: Key Elements and Terminology

Reading an option chain appears complicated at first glance, but mastering its core components unlocks invaluable insights. A standard NSE option chain is divided into two halves: call options (left) and put options (right), organized by a central column of strike prices.

The Building Blocks: Calls, Puts, and Strike Prices

- Strike Price: The predetermined price at which an option can be exercised.

- Call Options: Contracts that grant the right (but not the obligation) to buy the underlying asset at the strike price before expiry.

- Put Options: Contracts conferring the right to sell the asset at the strike price.

For every expiry date—weekly for indices or monthly for many stocks—the option chain displays a spectrum of strike prices, helping traders assess where concentrated activity (and thus, belief about future price levels) is occurring.

Understanding Open Interest and Volume

Two crucial data points stand out:

– Open Interest (OI): The total number of outstanding option contracts at a given strike price. High OI often signals strong interest or consensus at a certain level.

– Volume: The number of contracts traded in a specific session.

These figures, when compared to price changes and implied volatility, reveal much about underlying market psychology.

Premium and Implied Volatility

The premium is the price paid by the option buyer to the seller. It’s influenced not just by the proximity of the strike price to the underlying asset’s current value, but also by time to expiry, prevailing interest rates, and—crucially—implied volatility (IV), which reflects the market’s expectation of future price swings.

“Option chain analysis, when paired with awareness of implied volatility, offers a window into market expectations and can signal potential breakouts or reversals before they happen,” notes Ajay Garg, a veteran options strategist with a major Indian brokerage.

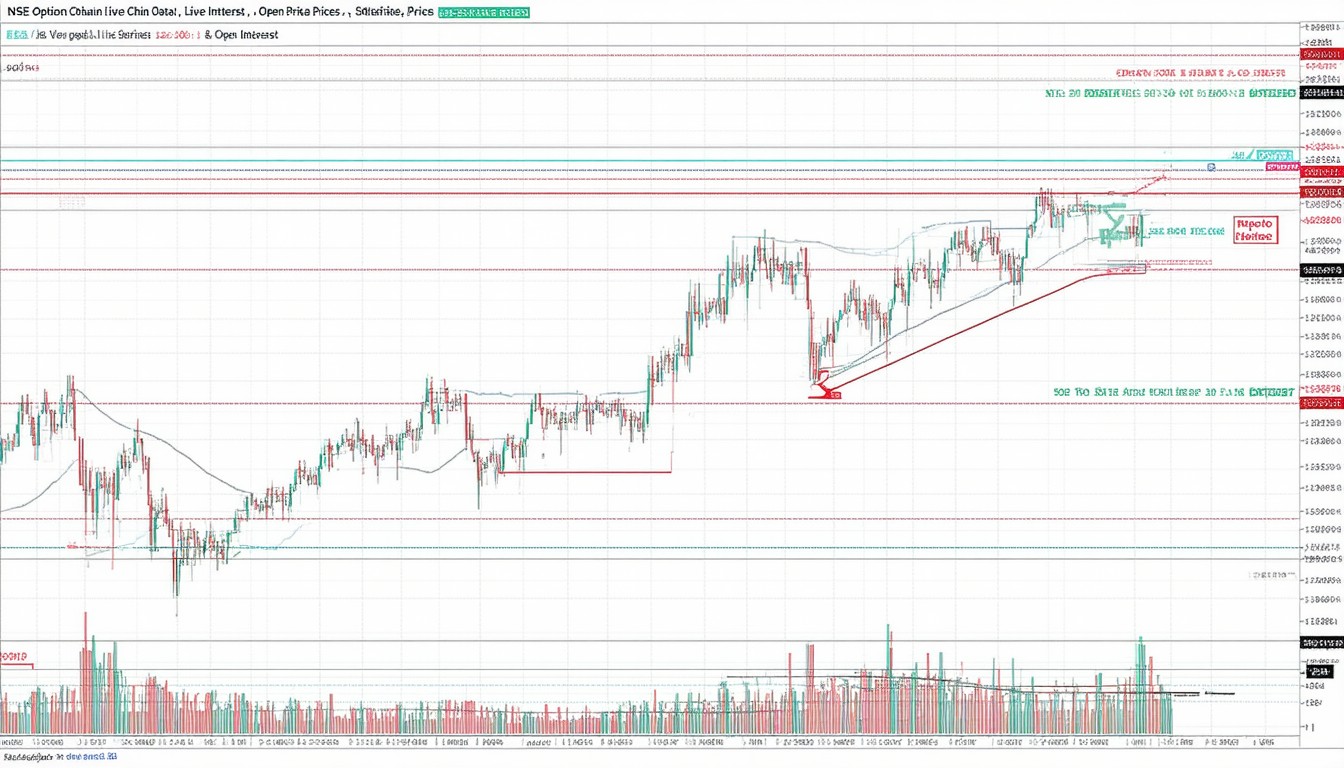

Using the Live NSE Option Chain for Trading Decisions

Real-time option chain data has transformed how active participants navigate the markets. Modern trading platforms and the official NSE website provide live-streamed updates, charting every change in volume, OI, and premium throughout the trading day.

Spotting Support, Resistance, and Sentiment

Trader communities and institutional desks alike use the option chain to identify:

– Support Zones (based on high put OI at lower strikes)

– Resistance Levels (determined by elevated call OI at higher strikes)

– Shifts in Sentiment (by observing rapid changes in OI or premium as news breaks)

For example, if the NIFTY 50 has unusually high put OI at the 18,000 strike, this often serves as an implied support zone, suggesting that many traders are betting the index won’t fall below this level by expiry.

Live Data in Action: A Mini Case

Consider a scenario where quarterly results spark heightened volatility in a leading bank stock. Swift changes in OI and premiums—tracked directly in the live NSE option chain—can foreshadow large institutional bets or emerging hedging needs. Savvy traders monitor these trails to anticipate breakouts or reversals, often in advance of the underlying stock’s actual move.

Potential Pitfalls and Caution

Despite its power, the option chain should not be used in isolation. Seasoned market participants warn against over-interpreting single-day spikes (which could represent algorithmic trades or hedging rather than directional conviction). Instead, sustainable trends in OI, especially when confirmed by price action and news, signal more reliable market intent.

Advanced Strategies Leveraging the Option Chain

Beyond basic identification of support and resistance, advanced users turn the NSE option chain into a launchpad for multifaceted strategies.

Building Spreads and Combination Trades

By analyzing shifts in option premiums and OI across different strikes and expiries, traders construct:

– Vertical Spreads (combining buys and sells at different strike prices)

– Straddles and Strangles (taking simultaneous positions on calls and puts to profit from volatility)

– Iron Condors (multi-leg strategies to capture range-bound moves)

Continuous monitoring of Greek values (like Delta, Gamma, and Theta) alongside changing option chain metrics helps in fine-tuning risk and reward.

Institutional Perspectives

Institutions use the depth of the NSE option chain for both proprietary trading and sophisticated hedging. For example, large funds may watch buildup in OI to anticipate market-wide reactions to events like RBI policy announcements or global macro developments.

Many algorithmic trading systems also scan live option chain feeds, looking for arbitrage or mean-reversion opportunities in real time.

Real-World Impact: Trends and Retail Participation

India’s retail participation in options has surged since 2020, supported by improved technology and greater access to education. Recent trends indicate that even smaller-sized investors rely on the NSE option chain for managing trades, despite the risks associated with leveraged products. This democratization of data has heightened both opportunity and volatility.

Regulators have responded by increasing investor awareness on the complexities and risks of derivative trading. Market veterans emphasize the need for strong risk management, especially for those new to using option chain data in live markets.

Conclusion: The NSE Option Chain as a Trading Compass

The NSE option chain offers a transparent, dynamic view into the pulse of India’s derivatives market. By combining live data on strike prices, open interest, and premiums, traders—from novices to institutional desks—can make more informed, evidence-backed decisions.

Yet, the key lies in disciplined interpretation, ongoing education, and viewing the option chain as one element in a holistic trading toolkit. Those who use it wisely stand to navigate turbulent markets with insight and confidence.

FAQs

What is an option chain on NSE?

An option chain on NSE is a comprehensive table showing available call and put options for a particular security, including strike prices, premiums, open interest, and volume for each contract.

How can open interest in the option chain indicate market direction?

High open interest at specific strike prices often spotlights support and resistance zones. Sudden changes in OI can also signal evolving sentiment or large players entering the market.

Where can I access the live NSE option chain?

The official NSE website provides real-time option chain data for indices and major stocks. Most brokerage platforms also offer live streaming of this information.

How does implied volatility affect option premiums?

Options with higher implied volatility tend to have more expensive premiums, reflecting greater perceived risk or expected price swings in the underlying asset.

Are there risks in relying solely on option chain data?

Yes, interpreting the option chain without considering broader market context, news, or technical analysis can lead to misleading conclusions or losses, particularly for inexperienced traders.

Can retail investors benefit from option chain analysis?

Absolutely—retail traders use the option chain to gauge sentiment and plan strategies, but should combine it with risk management and ongoing learning to mitigate potential pitfalls.

Leave a comment