Pattern recognition remains a cornerstone of effective technical analysis, especially in volatile financial markets. Among these patterns, the inverted head and shoulders stands out as a classic indicator of potential trend reversals. Originally popularized in equities trading, the inverted head and shoulders pattern is frequently observed across asset classes—from forex and commodities to cryptocurrencies. Understanding how this formation works, the signals it sends, and best practices for trading it are critical skills for both new and experienced market participants.

What Is the Inverted Head and Shoulders Pattern?

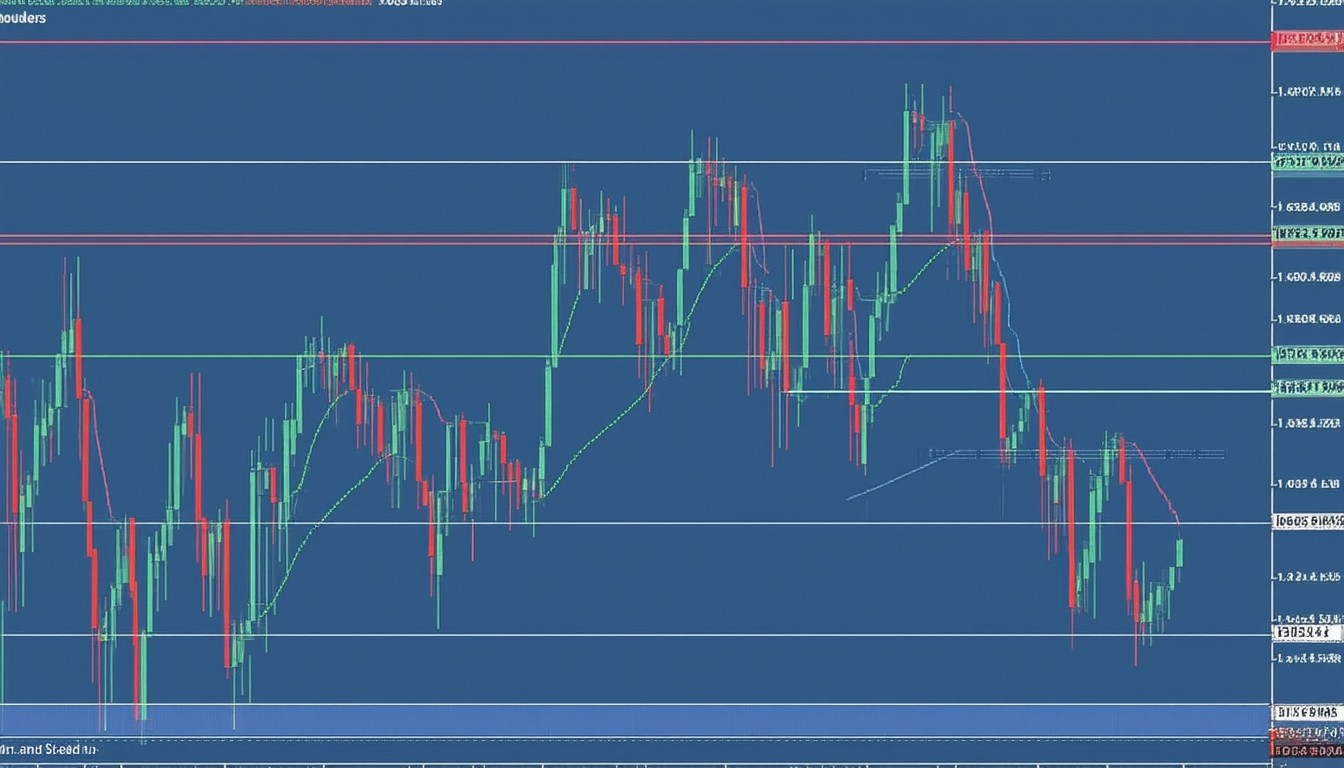

The inverted head and shoulders pattern is a bullish reversal chart formation. It typically appears after a sustained downtrend and suggests the potential onset of an upward price movement. The key features of the pattern are three distinct troughs (valleys) arranged horizontally—with the center trough (the “head”) being the lowest and the two flanking troughs (the “shoulders”) sitting higher and at relatively similar levels.

The neckline, a resistance line connecting the highs found between the head and each shoulder, marks the critical breakout level. Once price action breaks decisively above the neckline, many traders interpret it as confirmation of a trend change.

Components of the Inverted Head and Shoulders

- Left Shoulder: A price decline followed by a minor rally, forming the first trough.

- Head: A deeper price decline, surpassing the left shoulder, then another rally.

- Right Shoulder: A shallower decline resembling the left shoulder, followed again by a rally.

- Neckline: Drawn horizontally or slightly sloped, connecting the highs after the left shoulder and the head.

Historically, the reliability of the inverted head and shoulders has made it a mainstay in trading strategies. However, as with all patterns, context, confirmation, and prudent risk management are essential for successful execution.

Identifying the Pattern: Visual Cues and Confirmation Signals

Spotting a textbook inverted head and shoulders can be straightforward on clear charts, though real-world price movements rarely offer perfect symmetry. Traders need to train their eyes to capture the essence of the pattern even with some irregularities.

Typical Sequence

- Downtrend: The pattern must be preceded by a clear downtrend.

- Left Shoulder Formation: Price hits a low, bounces upward, but can’t sustain.

- Head Formation: New lows are reached, forming the deepest point, followed by another upward correction.

- Right Shoulder Formation: Price drops again but stalls above the level of the head, then attempts another rally.

- Neckline Break: Price surges above the neckline with increased volume—seen as the strongest buy signal.

Volume and Additional Confirmation

Volume analysis remains a widely used method to validate breakout strength within this pattern. Ideally, volume contracts as the pattern forms and then expands when the neckline breaks, confirming accumulating bullish sentiment. Supporting indicators like RSI moving above 50, or MACD bullish crossovers, can further strengthen the case.

“Reliable technical analysis is about stacking the odds in your favor. Patterns like the inverted head and shoulders should never stand alone—volume, momentum, and price action all work together to give a trustworthy signal.”

— Maria McNamara, Chartered Market Technician

How to Trade the Inverted Head and Shoulders Pattern

Converting technical analysis into a robust trading strategy involves more than pattern recognition. Understanding entry, exit, and risk management principles is crucial for trading the inverted head and shoulders effectively.

Step-by-Step Trading Process

- Identify the Pattern: Confirm a preceding downtrend, recognize all three troughs, and draw the neckline.

- Wait for Breakout: Enter a buy (long) position only after the price closes decisively above the neckline—with volume confirmation where possible.

- Target Setting: A widely used price target is calculated by measuring the vertical distance from the head to the neckline and projecting that distance upward from the neckline breakout.

- Stop Loss Placement: Stops are commonly set just below the right shoulder or the head, depending on risk tolerance.

- Monitor Pullbacks: Sometimes price revisits the neckline after the initial breakout. Such pullbacks can be opportunities for additional or late entries if bullish momentum resumes.

Example: Inverted Head and Shoulders in Equity Markets

In late 2020, several U.S. technology stocks displayed inverted head and shoulders patterns amid pandemic-fueled volatility. Traders who combined pattern recognition with volume analysis, and confirmed breakouts using supporting indicators, saw many stocks achieve their projected targets within weeks.

Advantages and Caveats: What Traders Should Know

No pattern is infallible. The inverted head and shoulders has historically offered reliable signals, but it also presents specific challenges.

Strengths

- Historical Reliability: Well-researched and backtested across multiple markets.

- Clear Entry and Exit Points: The neckline and measured-move targets provide structure.

- Adapts to Many Timeframes: Effective for swing, position, and even intraday traders.

Limitations

- False Breakouts: Markets can trigger breakouts only to reverse quickly, particularly in low-volume environments.

- Pattern Ambiguity: Real-world movements rarely mirror textbook diagrams, which can create misidentification risk.

- Lagging Nature: As a reversal pattern, it may signal a new trend after a substantial move has already occurred.

“No matter how robust a pattern seems, disciplined risk management and confirmation from multiple signals are the bedrock of consistent trading success.”

— Jamal Allen, Market Analyst

Integrating the Pattern into a Broader Trading Strategy

Beyond individual executions, the inverted head and shoulders is most powerful when integrated into a larger trading toolkit. Seasoned traders combine price patterns with broader market context, economic news, and quantitative models. Algorithmic trading funds, for example, sometimes code recognition of such patterns as part of automated strategies, with custom filters to weed out false positives.

Technical analysis continues to evolve. As new tools emerge and markets adapt to increasingly electronic and global trading environments, understanding the nuances of classic chart patterns like the inverted head and shoulders remains a highly valuable skill for traders aiming at consistent results.

Conclusion

The inverted head and shoulders pattern endures as a robust signal for trend reversals, especially when combined with volume analysis and other technical indicators. Its clear structure enables disciplined entries and exits, but traders should remain vigilant for false breakouts and always contextualize signals within broader market conditions. Effective technical analysis involves balancing pattern recognition with prudent risk management and multi-factor confirmation, ensuring traders act on the highest probability setups.

FAQs

What does the inverted head and shoulders pattern indicate?

It signals a potential reversal from a downtrend to an uptrend, suggesting that buying momentum may be building.

How do you confirm the validity of this pattern?

Confirmation typically involves a price breakout above the neckline, accompanied by increased trading volume and ideally supported by other technical indicators.

Is the inverted head and shoulders effective in all markets?

While widely used in equities, forex, and crypto, its effectiveness can vary depending on market volatility, liquidity, and timeframe.

Where should a stop loss be placed when trading this pattern?

A common approach is to set a stop loss just below the right shoulder or just under the lowest point of the head, adjusting for personal risk tolerance.

Can the pattern fail, and how often does it give false signals?

No pattern is foolproof; false breakouts do occur, especially in thinly traded or highly volatile markets. Using confirmation tools and proper risk management can help mitigate such risks.

Leave a comment